Hey everyone, welcome back to the blog. Let’s just state the obvious: you can’t open a browser, watch a video, or read a headline without being bombarded by “AI.” It’s everything, everywhere, all at once. We’re seeing companies we’ve never heard of get valued at billions of dollars overnight. We’re seeing Nvidia, the company that makes the chips, become one of the most valuable corporations on Earth. It’s exciting, it’s terrifying, and if you’ve been around the tech world for a bit, it feels… familiar.

A little too familiar, right?

I can’t be the only one getting massive 1999 flashbacks. That same electric “this changes everything” feeling is in the air. But so is that little voice in the back of my head whispering one term over and over: AI Bubble.

The big question on everyone’s mind is no longer if AI is revolutionary, but if the financial hype has completely detached from reality. Are we riding a wave of innovation, or are we all just standing in a massive AI Bubble that’s seconds away from bursting? I’ve been digging into this, and honestly, the answer is a complicated “yes.” Let’s unpack this.

What Even Is the AI Bubble We’re All Talking About?

First off, what does “bubble” even mean in this context?

An AI Bubble isn’t about the technology itself being fake. The tech is very real. The AI Bubble refers to the speculative frenzy around it. It’s a classic stock market bubble where the price of assets (like AI company stocks) gets pumped up way beyond their actual, tangible value.

It’s fueled by a potent mix of FOMO (Fear Of Missing Out), media hype, and herd mentality. Venture capitalists (VCs) are pouring trillions of dollars into any startup with “.ai” in its name, terrified of missing out on the “next Google.” Tech giants like Microsoft and Google are in a multi-trillion-dollar arms race, spending billions on their own models and investing in startups like Anthropic and OpenAI.

This creates a feedback loop: the hype drives investment, the investment drives valuations, and the sky-high valuations create more hype. The problem is that this entire house of cards is built on the promise of future profits, not necessarily the reality of current ones.

The Déjà Vu is Real: Echoes of the Dot-Com Crash

If you’re new to tech, let me paint you a picture of the late ’90s. It was a time when a company called Pets.com, which sold pet food online (and was famously unprofitable), raised $82.5 million in an IPO. It went bankrupt less than a year later.

This was the “dot-com bubble.” Investors were convinced that the internet was the future (which it was) and that any company with a website was the next big thing (which they weren’t). They stopped looking at fundamentals like, you know, profit, and started valuing companies on new metrics like “eyeballs” and “clicks.”

Sound familiar?

Today, we’re seeing the same behavior. Startups with a handful of employees and a thin wrapper around an OpenAI API are getting “unicorn” valuations of over a billion dollars. The metrics are just as fuzzy. We’re not talking “eyeballs,” but “compute power,” “parameter size,” and “user adoption rates.” ChatGPT hitting 100 million users was staggering, but how many of those users are paying? How many are just messing around?

This desperate search for “the next big thing” is a classic sign of a speculative AI Bubble. We’re seeing the same irrational exuberance that led to one of the biggest market crashes in tech history.

But Hold On… This Isn’t 1999 2.0

Okay, so it’s easy to be a pessimist. But it’s also lazy. Ignoring the very real, fundamental differences between this AI boom and the dot-com bubble is just as dangerous as ignoring the hype.

This isn’t 1999 for one very, very big reason: the companies leading the charge are insanely profitable.

Back then, the boom was led by unprofitable startups with no business model. Today, the “Magnificent 7” (Microsoft, Google, Amazon, Apple, Meta, Tesla, and Nvidia) are bankrolling this revolution. These are not speculative startups; they are cash-printing machines.

Microsoft isn’t just hoping AI pays off; it’s already bundling its Copilot AI into its Office suite and charging $30/month for it, generating billions in new, high-margin revenue. Google is integrating AI directly into its search and cloud platforms.

And then there’s Nvidia.

Nvidia isn’t selling a promise; it’s selling the picks and shovels in a gold rush. Every single company, from the smallest startup to the biggest tech giant, needs Nvidia’s GPUs to train and run their AI models. Its revenue and profits aren’t hypothetical; they are astronomical and very, very real.

Furthermore, the technology actually works. The dot-com bubble was built on the idea that you could one day order a pizza from your computer. The AI boom is built on technology that can right now write your code, draft your legal contracts, discover new medical drugs, and create art. The adoption is real, and the productivity gains, in some cases, are already here.

The “Haves” and the “Have-Nots” of the AI Boom

So, here’s my personal theory. I don’t think the AI Bubble is one single, giant bubble that will pop all at once.

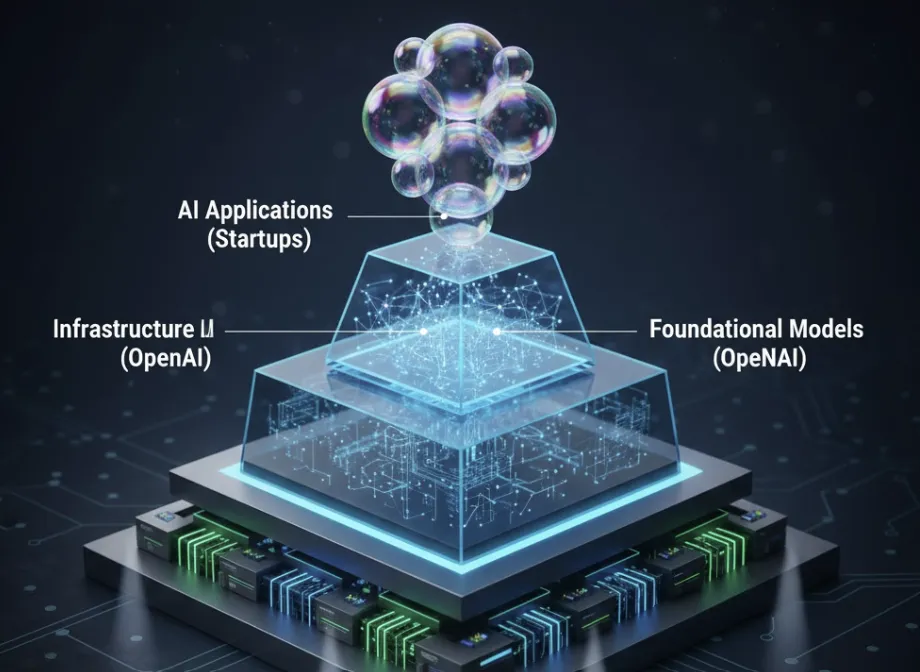

Instead, I think we’re seeing three very different markets, all lumped under the “AI” banner:

- The Infrastructure (The “Shovels”): This is Nvidia, AMD, and cloud providers like Amazon AWS and Microsoft Azure. They are making real money right now. Their stocks are expensive, for sure, but they’re backed by some of the strongest earnings growth we’ve ever seen. This isn’t a bubble; it’s a boom.

- The Foundational Models (The “Gold Mines”): This is OpenAI, Anthropic, Cohere, etc. This is where it gets bubbly. They are raising tens of billions of dollars, but their costs are insane. It costs hundreds of millions of dollars in compute power just to train a new model. Is their business model sustainable? Can they ever become profitable enough to justify their half-trillion-dollar valuations? This is a huge maybe.

- The Applications (The “Prospectors”): This is the thousands of startups that are “AI-powered.” This, in my opinion, is the real AI Bubble. 99% of these companies have no defensible technology. They are just a nice-looking user interface built on top of OpenAI’s API. When the funding dries up, or when OpenAI releases a new feature that does what their entire company does, they will vanish overnight. This is Pets.com all over again.

The Big Red Flags We Can’t Ignore

Even with the real tech and real profits, there are some serious red flags that scream AI Bubble.

The biggest one for me? Circular investments. My research turned up this crazy-sounding but very real scenario: a VC firm and a tech giant (like Nvidia or Microsoft) invest $500 million into a new AI startup. That startup then turns around and spends $400 million of that same money on compute power from… you guessed it, Microsoft Azure or Nvidia.

It looks like the startup has customers and the tech giant has massive AI revenue growth. But is it real? Or is it just a bunch of companies passing the same bag of money around in a circle to inflate their own valuations? That’s a classic bubble-icious move.

Then there’s the ROI (Return on Investment) problem. A recent MIT study found that a staggering 95% of AI pilot projects fail to deliver any measurable financial return. Companies are spending billions on AI, but most aren’t seeing it translate to their bottom line. The hype is writing checks that the technology, in its current state, can’t cash.

And finally, listen to the insiders! Even Sam Altman, the CEO of OpenAI, has publicly stated that he thinks the market is “bubbly” and that some of this hype is irrational. When the guy blowing the AI Bubble tells you it’s a bubble, you should probably pay attention.

So, Will the AI Bubble Pop? And What Happens Then?

Yes. 100%. But it won’t be the apocalypse that some are predicting.

The great AI Bubble burst of 2026/2027 won’t be a single event. It will be a painful, necessary filtering.

I predict the “Application” layer I mentioned will collapse almost entirely. Thousands of me-too startups will go bankrupt. VCs will lose their shirts, and there will be a lot of sad “I’m leaving my AI startup” posts on LinkedIn. This is the AI Bubble popping, and it will be brutal for those caught in it.

But the foundational companies? The infrastructure players? They’ll be fine. They’ll swoop in and buy the few surviving, innovative startups for pennies on the dollar. The hype will die down, the charlatans will be flushed out, and the real work of building a new economy on this tech will begin.

This is the natural, healthy, and terrifying cycle of every technological revolution. It happened with the railroads, it happened with the internet, and it’s happening right now with AI.

What This AI Bubble Means for You

As a reader of this blog, this isn’t just abstract investor talk. This AI Bubble and its inevitable correction will affect the tech we all use, the jobs we have, and the news we read.

It’s a reminder to be skeptical. Don’t fall for every product that claims to be “AI-powered.” Ask the hard questions: What does it actually do? Does it solve a real problem? Or is it just marketing hype?

For those of us in the tech world, it’s a call to focus on real, durable skills. This is a big, chaotic, and exciting topic, and it’s just one of many we cover in our IT and Technology news section.

If you want a much deeper, data-driven dive into this, the AI bubble Wikipedia page is actually an excellent, constantly updated resource that separates fact from fiction.

Ultimately, the AI Bubble is real, but so is the underlying technology. The hype is temporary, but the shift is permanent. The next few years are going to be a wild ride as we separate the revolutionary from the ridiculous.

What’s your take? Are you cashing in your stocks and bracing for a crash, or do you think this is just the very beginning? Let me know your thoughts in the comments.